Advocacy

Tax Incentive

To encourage the participation of private sector in promoting the development of arts and culture ec

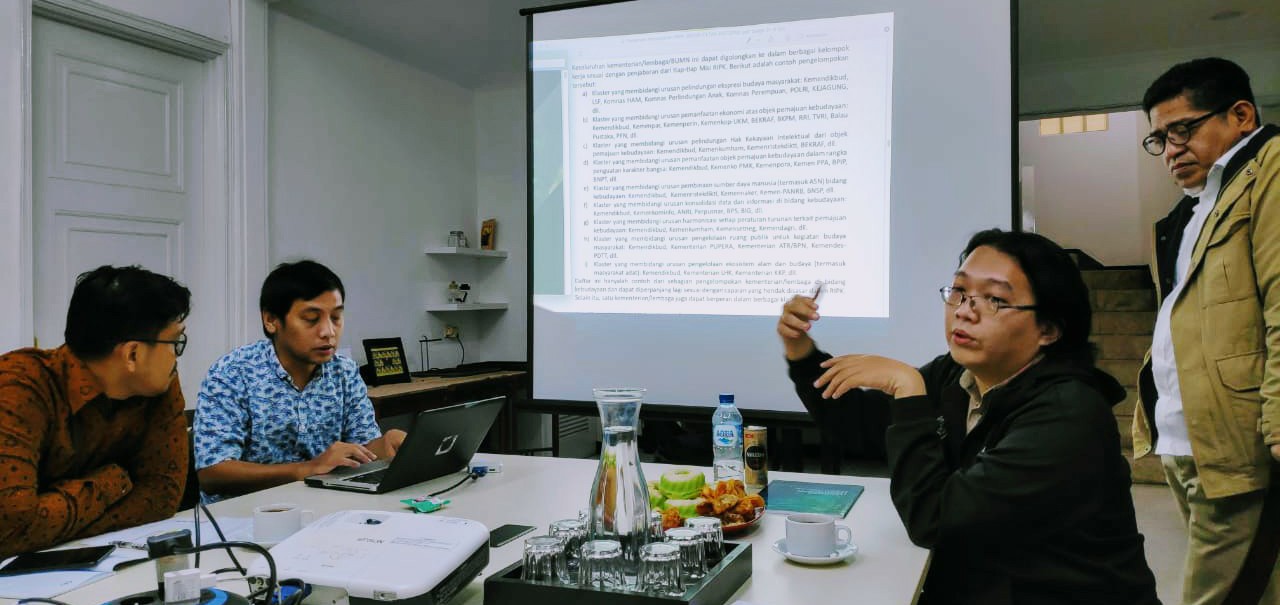

Private sector, government, arts and culture activists

- Monitoring the implementation of the Government Regulation Number 45 of 2019 for arts and culture.

The arts and culture development are generally not-for-profit activities, and for that reason, artists frequently need funding from the private sector. During the negotiation process with the potential donor, artists proposing for funds may offer the tax incentive policy as a benefit for the donor.

One of the regulations serving as the basis for this initiative is the Government Regulation Number 93 of 2010 concerning Income Tax Incentives for Grants, which has been applicable since the 2010 tax year. Based on that policy, the company which acts as a donor for arts and culture activities is eligible for a tax cut up to 25% of the donation amount. Other regulations on tax incentives include the Investment Law Number 25 of 2007 Article 15 point (b), the Limited Liability Company (PT) Law Number 40 of 2007 Article 74, and the Regulation of the Ministry of Finance Number 76/PMK.03/2010 concerning Donations.

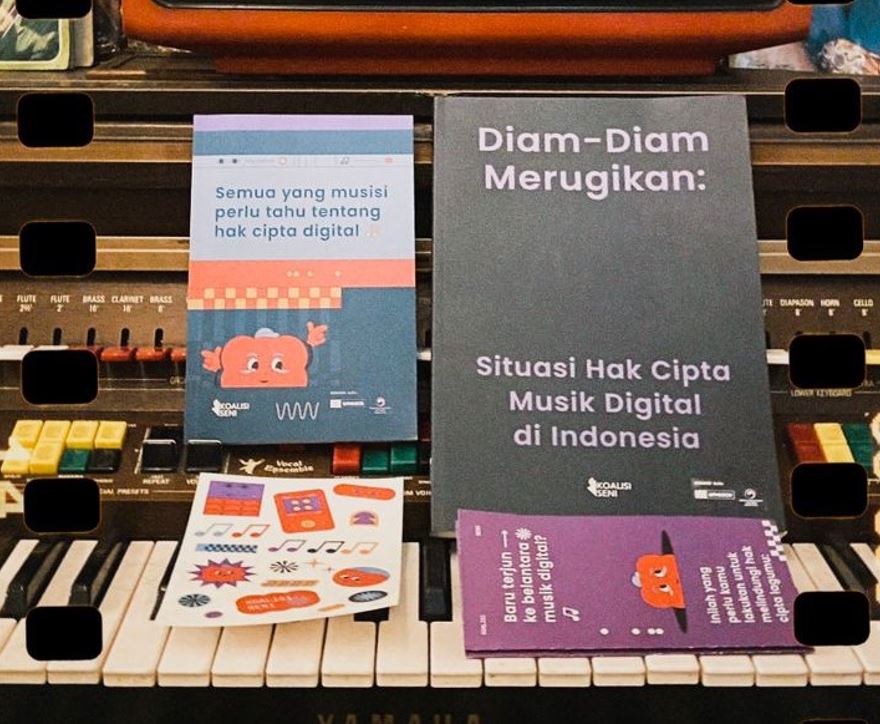

Many companies and arts activists do not notice this tax incentive policy yet, therefore Koalisi Seni has been actively disseminating the information since 2012.

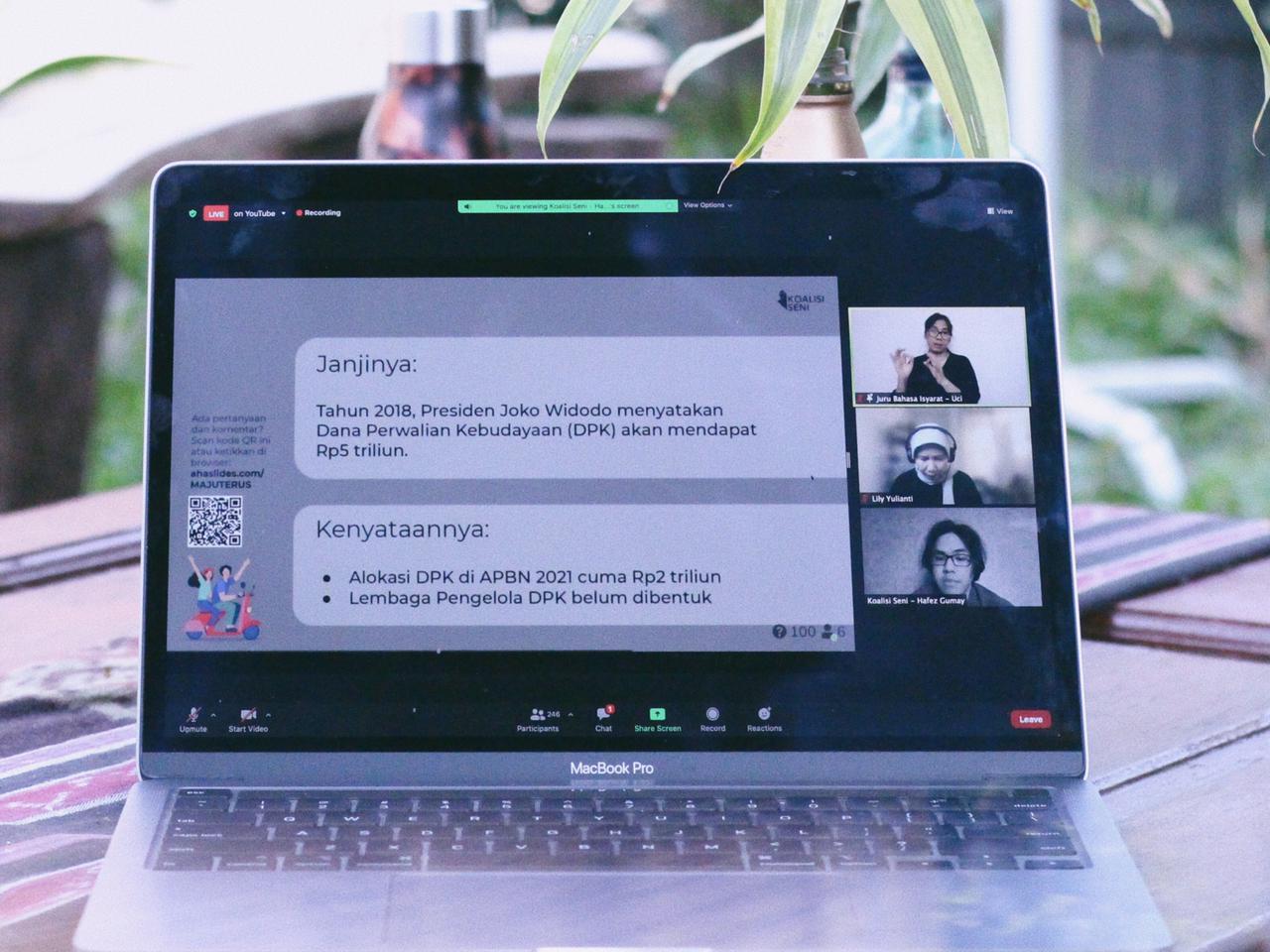

Koalisi Seni is currently monitoring the Government Regulation Number 45 of 2019 on Amendment to the Government Regulation Number 94 of 2010 on Calculation of Taxable Income and Income Tax Payment within the Current Year. The so-called “super tax deduction” stipulates a reasonably high tax incentive for vocational as well as research and development activities, which should also be implemented for arts and culture activities.

- Presentation on Tax Incentive (in Bahasa Indonesia)

- Infographic of Tax Incentive for Arts and Culture Donation (in Bahasa Indonesia)

- Infographic of Tax Incentive for Arts and Culture Activities Promotion Expense (in Bahasa Indonesia)

- Government Regulation Number 93 of 2010 on Social Donation Deductible from Taxable Gross Income (in Bahasa Indonesia)

- Regulation of the Minister of Finance Number 76/PMK.3/2011 on Tax Incentive Registration and Reporting Procedure (in Bahasa Indonesia)

- Government Regulation Number 45 of 2019 on Amendment to the Government Regulation Number 94 of 2010 on Calculation of Taxable Income and Income Tax Payment within the Current Year (in Bahasa Indonesia)

- Regulation of Minister of Finance Number 128/PMK.010/2019 on Provision of Deduction of Gross Income for Implementation of On-the-job Training, Internship, and/or Learning for the Purpose of Human Resource Development Based on Particular Competencies (in Bahasa Indonesia)

-

Linda Hoemar Abidin Member of Koalisi Seni’s Executive Board

The policy is an appreciation for the donors that have reduced the government’s burdens through the donation. It is so unfortunate that the companies which have funded arts and culture activities do not take advantage of this incentive.

-

Michael Budiman Mulyadi Music and Arts Management Instructor at Universitas Pelita Harapan, Member of Koalisi Seni

It is hoped that the tax incentive can attract more philanthropists so that artists can have more freedom in choosing and working on their ethical artistic vision as well as in expressing their creativity.

![Pemahaman animasi yang lebih akurat dari sekedar “gambar bergerak” akan membawa kita pada keterbukaan akan berbagai kemungkinan dalam memberdayakan medium yang (semestinya) khas ini. Modul Bekal Seni berikut memaparkan tentang apakah animasi itu, bagaimana sejarahnya, dan apa saja dimensi-dimensi [film] animasi yang perlu diperhatikan oleh seorang animator. Hal-hal yang perlu kita timbang dengan seksama, jika kita sungguh-sungguh ingin menghasilkan karya animasi Indonesia yang unggul.](https://koalisiseni.or.id/wp-content/uploads/2019/08/website-768x417.jpg)